People often start their financial journey with an online search, and banks that have a strong online presence can attract new customers easily.

SEO for banks helps financial organizations stay competitive in the digital landscape. Ranking high in search results suggests credibility and trustworthiness to consumers, which in turn improves a bank’s branding and goodwill.

There are certain effective SEO tips for banks, which, when applied, improve organic search engine presence.

In this article, I will discuss the top SEO tactics for the banking industry to achieve high rankings.

What is SEO for Banks?

SEO for banks refers to the practice of optimizing a bank's online presence to improve its visibility in search engine results when users search for relevant financial services, products, or information.

Baking SEO involves a series of strategies and techniques aimed at making a bank's website more search engine-friendly and user-friendly, ultimately leading to increased organic traffic and better online performance.

Do Banks Need SEO Services?

Yes, banks need search engine optimization services, just like any other business or organization operating in the digital age.

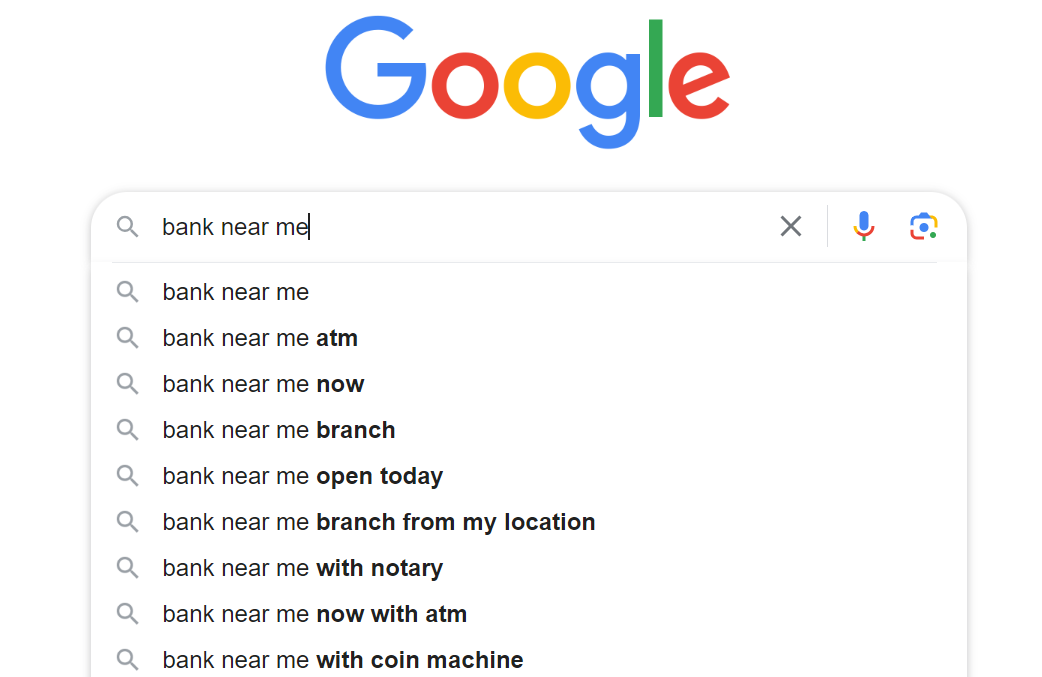

Search queries for “bank near me” have grown by more than 60% in the past few years. This indicates that people search for banks online before they visit the place physically. Hence, performing local SEO for banks is crucial.

Moreover, SEO-acquired leads have a 15% conversion rate, meaning SEO leads generated via banking SEO are of high-quality with excellent conversion probability.

Here are some of the top reasons why banks should consider investing in SEO services:

Increased Online Visibility

SEO services help banks improve their search engine rankings, making their website more visible to potential customers. Higher visibility means more organic traffic, which can lead to increased customer engagement and conversions.

Local Presence

For banks with physical branches, local SEO is essential. Local SEO companies and in-house teams consisting of SEO experts can help banks optimize their website for local searches, ensuring that customers can easily find branch locations and services in their area.

Competitive Advantage

The banking industry is highly competitive, with numerous banks vying for the same customers. Effective SEO strategies help a bank stand out by highlighting its unique value propositions and offerings.

Targeted Traffic

SEO services help banks attract highly targeted traffic. By optimizing for specific keywords and phrases related to their services, banks can attract users who are actively searching for the financial solutions they offer.

Content Marketing

SEO services often include content creation and optimization. This allows banks to provide valuable and informative content to their customers, positioning themselves as trusted sources of financial information and advice.

User Experience Improvement

SEO agencies and in-house SEO teams work to improve the technical and user experience aspects of a website. A user-friendly website with fast loading times and easy navigation can lead to higher engagement and better search rankings.

Long-Term Benefits

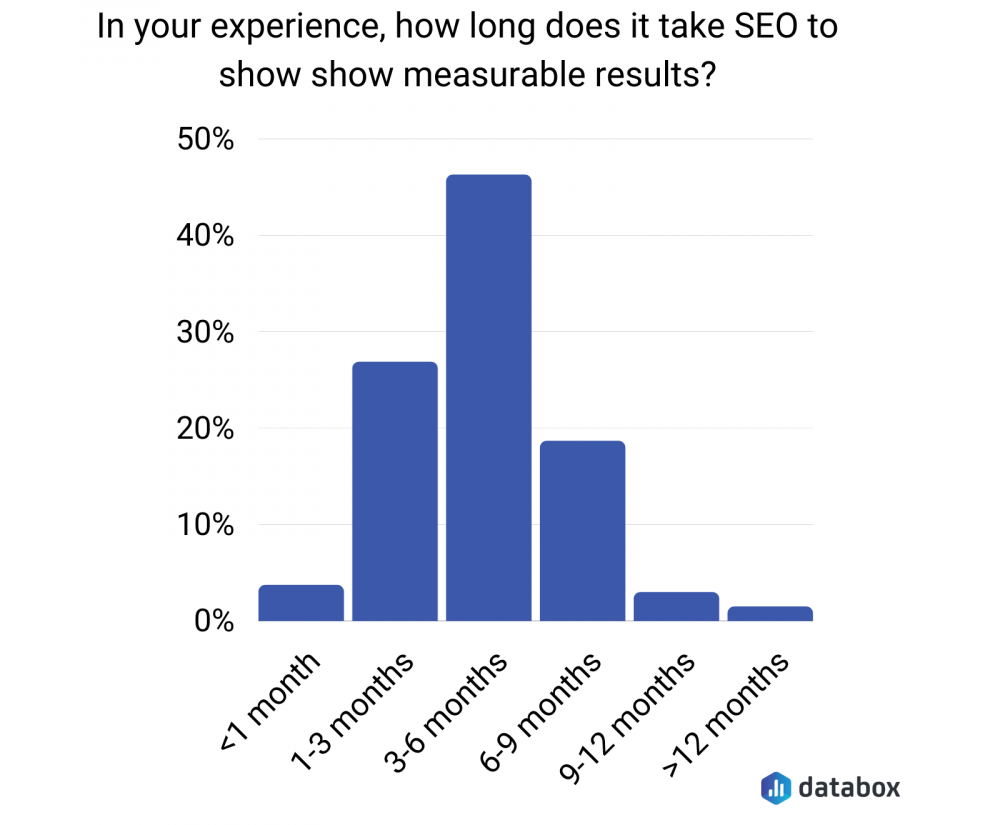

Unlike some forms of advertising that provide short-term results, SEO is a long-term strategy. In fact, according to various experts sampled by Databox, it takes at least 3 to 6 months to see measurable results.

However, once a bank's website starts ranking well for relevant keywords, it can continue to attract organic traffic without ongoing high costs.

Reputation Management

SEO services provide banks with the tools and strategies needed to effectively manage their online reputation by strategically highlighting content (company blogs, guest posts, media publications, and social media content that highlight your business’s achievements) while minimizing the impact of negative information (negative reviews or posts) in search results.

By optimizing existing positive content, creating new engaging and informative materials, and strategically positioning these assets, banks can control the narrative surrounding their brand.

This ensures that potential customers encounter a more accurate and positive representation of the bank's offerings, values, and customer satisfaction when they search online.

Adapting to Digital Trends

As more people rely on their smartphones and voice-activated assistants to find answers and access services, banks need to proactively adjust their digital strategies to remain relevant and accessible to their target audience.

Image source: Oberlo

Leveraging SEO services empowers banks to tailor their websites and content for mobile and voice-oriented experiences, ensuring they remain competitive and accessible to a diverse range of consumers.

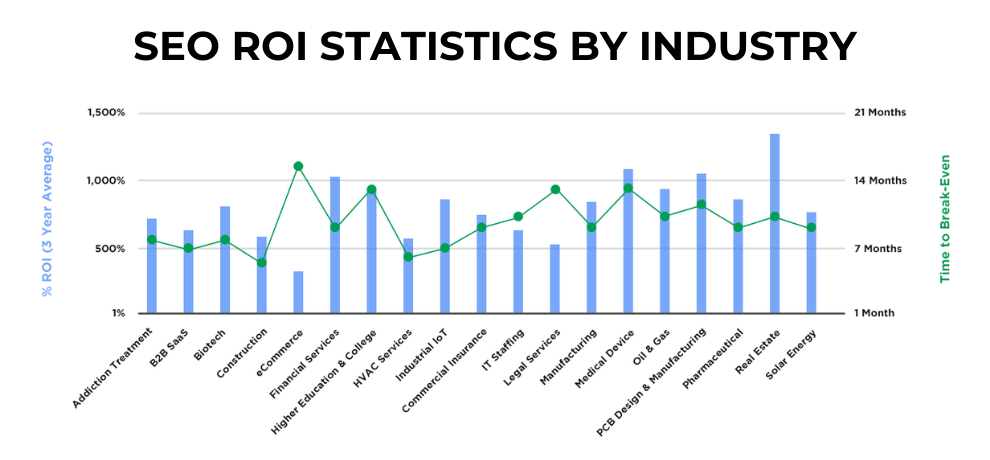

Return on Investment (ROI)

Implementing a well-rounded and strategic SEO approach that aligns with the bank's goals helps to increase the chances of achieving a high ROI by attracting targeted organic traffic, converting leads, and improving online visibility and reputation.

Image source: First Page Sage

SEO Tips for Banks

Here are the best SEO tips for the banking industry:

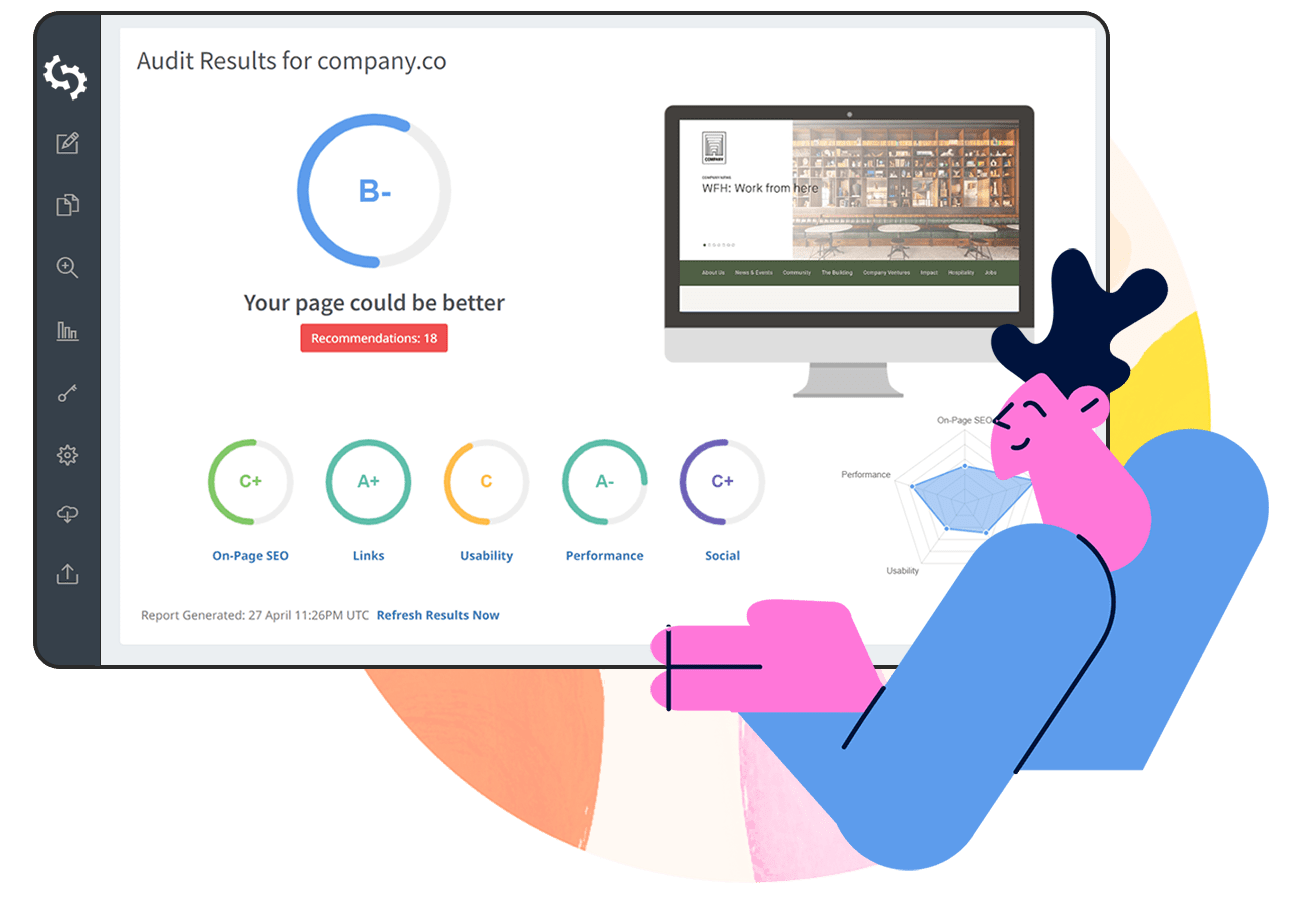

Perform On-Page Keyword Optimization

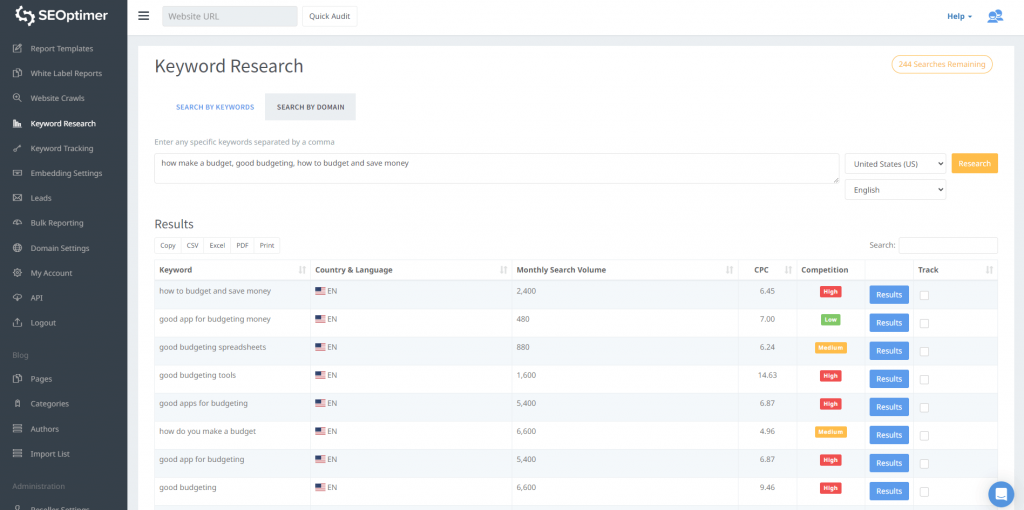

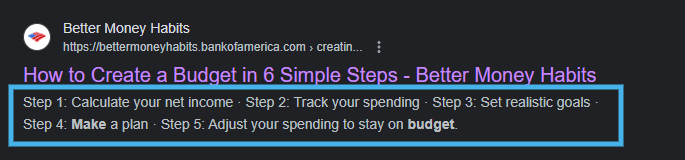

Start by conducting comprehensive keyword research to identify the keywords that potential customers might use when searching for banking services.

Consider both primary keywords (broad terms) and long-tail keywords (more specific, detailed phrases). And focus on the keywords that have a good balance between search volume and competition.

Once the keyword list is prepared, assign specific target keywords to relevant pages on your website. Each page should focus on a primary keyword and potentially include related secondary keywords.

Now incorporate the primary keyword into the title tag and URL of the page. The title tag is an important on-page element that search engines display in search results. Make sure the title is descriptive, concise, and engaging.

Similarly, a clear and concise URL that reflects the page's topic can help search engines understand the content.

Also, write a compelling meta description that includes the primary keyword at the beginning.

Include the primary and secondary keywords in the heading tags to increase the relevance of the page for those keywords.

Finally, incorporate your target keywords naturally into the content of the page. Focus on providing valuable and informative content that addresses the needs of users while integrating keywords in a reader-friendly manner.

Create Relevant Infographics and Visual Content

Creating relevant infographics and visual content for a bank can enhance its online presence, engage customers, and communicate complex financial information in an easily digestible format.

Image source: IDFC First Bank

Determine the topics or concepts you want to convey through infographics. These could include explanations of banking services, financial tips, investment strategies, mortgage processes, and more.

Outline the structure and flow of your infographic. Decide on the main sections, data points, and visual elements you'll include.

Remember to include your bank's logo and branding elements to reinforce your identity, this helps establish credibility and recognition.

Once your infographic is complete, promote it on your bank's website, social media platforms, and relevant online communities.

Link Building for Banks

Link building for banks involves the strategic process of acquiring high-quality backlinks from authoritative and relevant websites. These backlinks not only improve a bank's search engine rankings but also contribute to its credibility and reputation within the financial industry.

Offer to write guest posts for reputable financial and banking blogs. Ensure that your guest posts provide valuable insights and information to readers.

In your guest blogs, include a relevant and contextual backlink to your bank's website.

You should also forge partnerships with other businesses, organizations, or influencers within the financial industry. These collaborations can lead to opportunities for guest posts, joint webinars, or co-created content, which may include backlinks.

Also, submit your bank's website to relevant financial industry directories and associations. These authoritative platforms can provide valuable backlinks and enhance your bank's credibility.

Finally, distribute press releases about significant events, achievements, or newsworthy updates related to your bank. High-quality press releases can attract attention from news websites and result in authoritative backlinks.

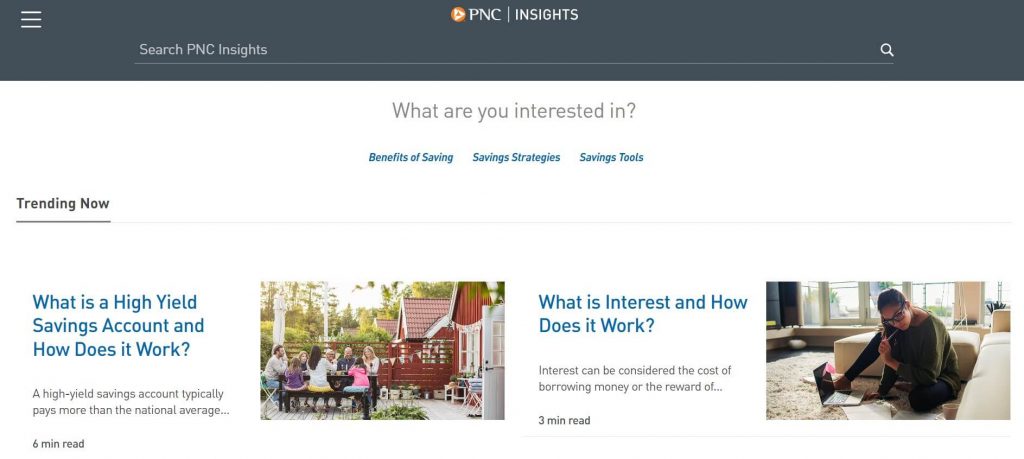

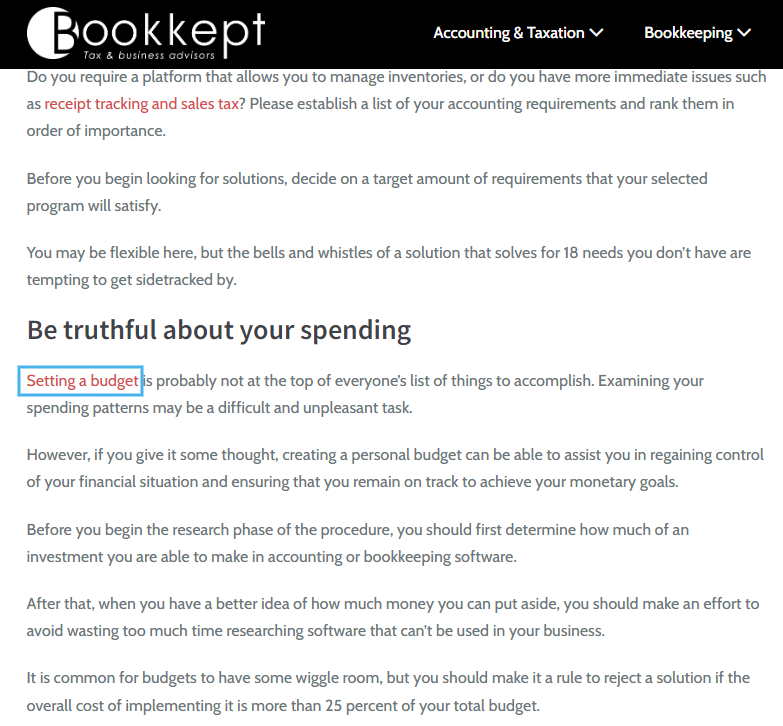

Write In-Depth Guides on Your Bank’s Blog

Create in-depth guides that provide detailed, accurate, and actionable information that resonates with your target audience. Incorporate visuals, examples, and real-life scenarios to make the content engaging and relatable.

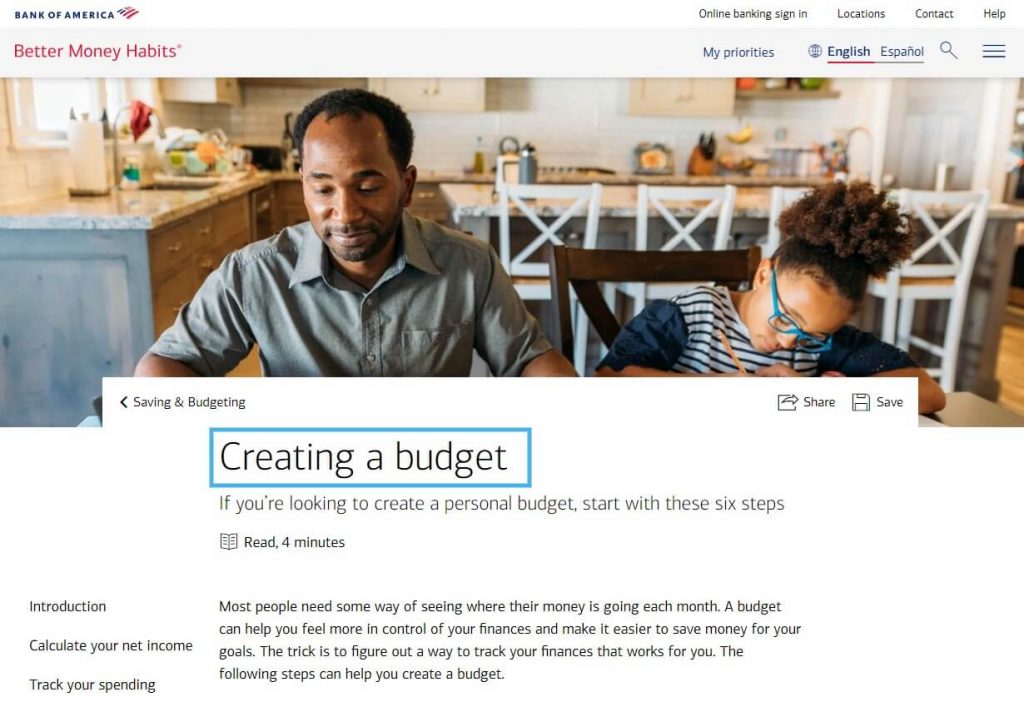

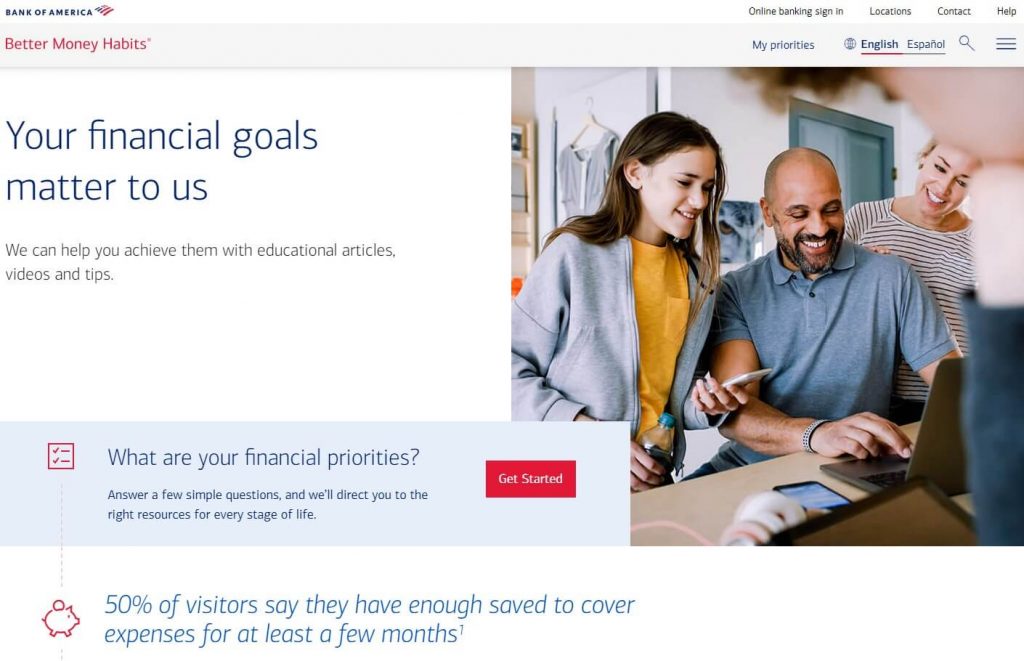

For example, Bank of America publishes lots of useful articles for the readers on its Better Money Habits blog:

The blog has plenty of categories containing hundreds of articles on money and investment.

By publishing comprehensive financial guides on your bank's blog, you can position your institution as a reliable source of financial education and advice, fostering trust and loyalty among your customers.

Here are some in-depth guide examples that you can cover on your bank’s blog:

- Understanding Credit Scores and Reports

- Guide to Home Buying

- Managing Personal Debt

- Understanding Different Loan Types

Create a Local SEO Strategy

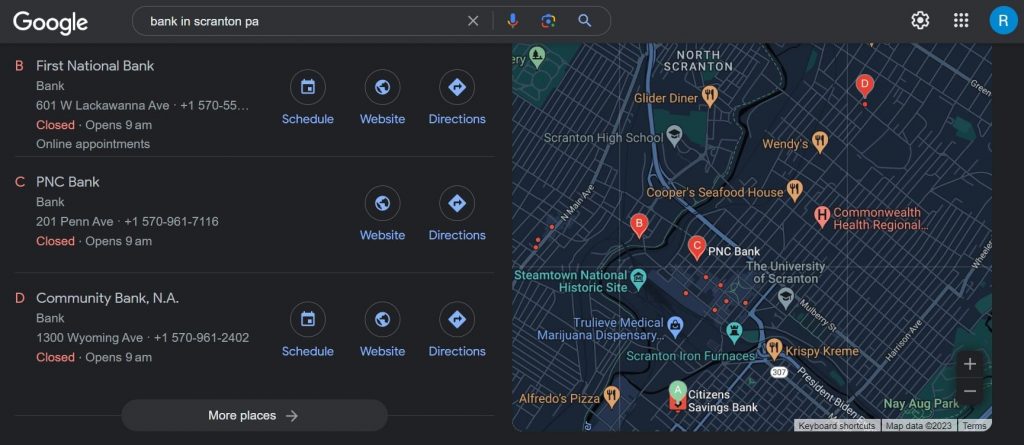

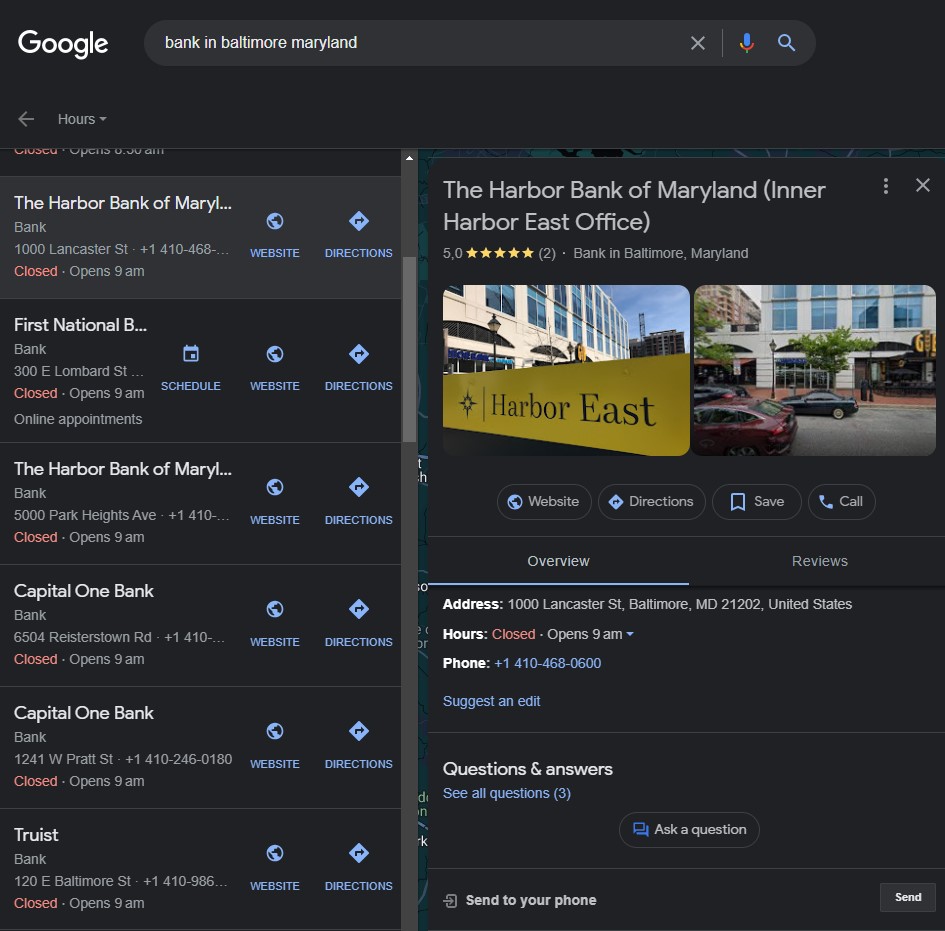

Creating a local SEO strategy for your bank is essential for attracting customers in your specific geographic area. Local SEO helps your bank's branches appear prominently in local search results when users search for banking services near them.

Start by claiming and verifying your bank's Google Business listing (if you haven’t done so already). Ensure that all details—such as name, address, phone number, website URL, and business hours—are accurate and consistent with your bank's information.

If your bank has multiple branches, create separate Google Business listings for each location. This can increase visibility in local searches and allows users to find the nearest branch easily.

Although you should create a listing for each individual brank or location, you can still manage these listings in one account. Check out our blog post on how to add multiple Google Business listings with the same name to get detailed instruction on how to do so.

Encourage satisfied customers to leave positive reviews on your Google Business listing. But remember to respond to reviews, both positive and negative, professionally and promptly.

Ensure NAP Details are Consistent Across the Web

Ensuring consistent NAP (Name, Address, Phone Number) details across the web is crucial for local SEO and maintaining a trustworthy online presence.

Begin by conducting an audit of all existing online listings, directories, and platforms where your bank's NAP details are mentioned. This includes a Google Business audit, Yelp, Yellow Pages, industry-specific directories, social media profiles, and more.

Choose a standard format for your bank's NAP details and stick to it consistently.

For example:

Name: My Bank

Address: 123 Street, City, State ZIP

Phone Number: (123) 456-7890

Make sure the NAP details on your bank's website are accurate and match the standard format. This includes the footer, contact page, and any other relevant pages.

The best approach is to create a document that includes your bank's standard NAP details and share it with team members responsible for updating online listings and profiles.

Build On-Site Tools for Customers

Building on-site tools for customers on your bank's website can enhance their experience, provide valuable resources, and establish your bank as a helpful and innovative financial institution.

Moreover, tools are the best resources to attract natural backlinks to your website, leading to higher domain authority.

Here are some on-site tool ideas for your bank’s website:

- Mortgage Calculator that allows users to estimate monthly payments based on loan amount, interest rate, and loan term. This tool can be invaluable for users exploring home financing options.

- Loan Eligibility Checker that helps users check their eligibility for different types of loans, such as personal loans, auto loans, and home loans, by inputting their financial details.

- Budget Planner that assists users in creating and managing a monthly budget. It could track income, expenses, and savings goals to provide actionable insights.

- Currency Converter that helps users quickly convert between different currencies.

- Credit Score Estimator that helps users estimate their credit score based on factors like payment history, credit utilization, and length of credit history.

When building these on-site tools, prioritize user-friendly interfaces, clear instructions, and accurate calculations.

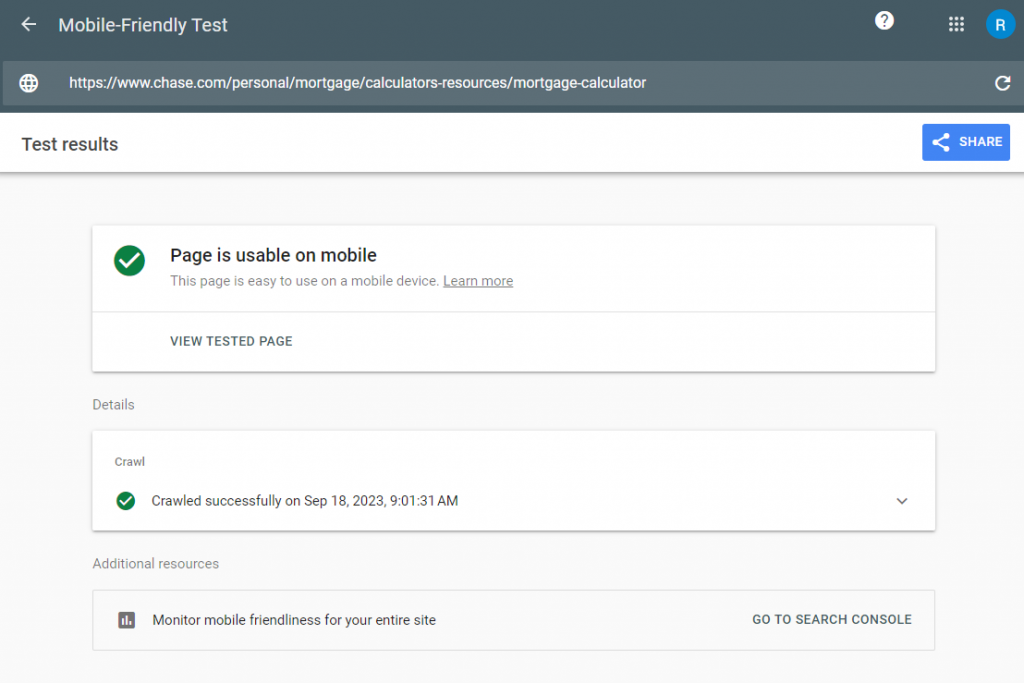

Have Mobile-First Website Design

Implement responsive web design that automatically adjusts the layout and content based on the user's device screen size. This ensures a consistent experience across devices.

Opt for clean and uncluttered layouts that prioritize essential content and make navigation intuitive. Simplify menus and eliminate unnecessary elements.

Ask your web developer to design buttons, links, and interactive elements with touch in mind. Ensure that these elements are easily tappable, with enough space between elements to avoid accidental clicks.

Lastly, use Google's Mobile-Friendly Test tool to assess your website's mobile-friendliness and identify any issues that need addressing.

Conclusion

As the financial landscape evolves and consumers increasingly turn to the internet for their banking needs, leveraging these eight top SEO tactics for banks can yield significant benefits.

By implementing these tactics, banks can position themselves as reputable, authoritative, and customer-centric institutions, securing higher Google rankings and fostering lasting relationships with their audience.