So you've built a digital marketing agency and you're living the dream.

But what happens if one day you come to the realization that you want to sell your agency? Most agency founders don't anticipate this scenario when they start.

They usually don't have an "exit strategy" in mind. Agencies aren't the type of asset that one builds and flips for a handsome profit (although that can absolutely be the case).

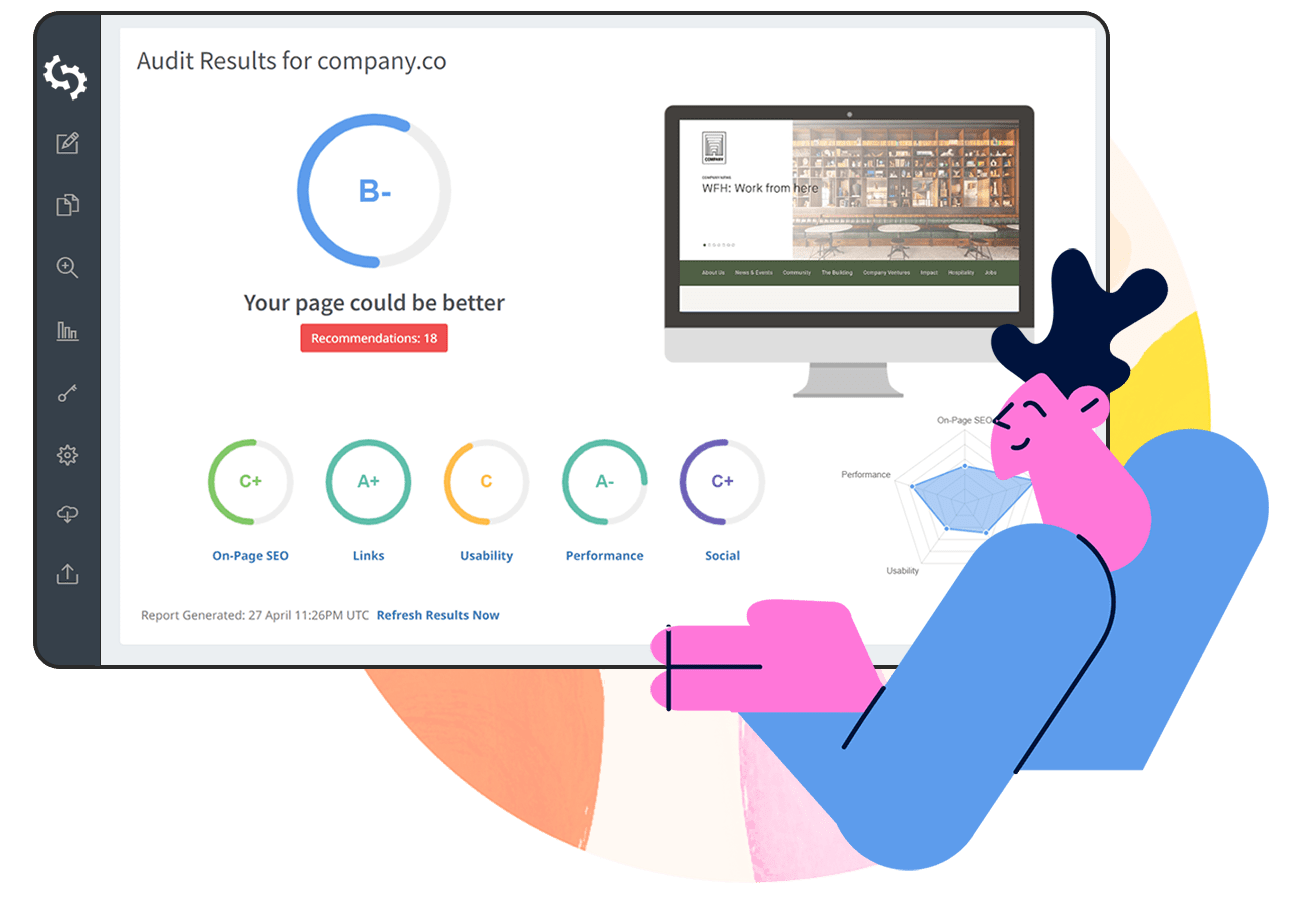

We wrote this guide because most of our customers here at SEOptimer are digital agency founders and there aren't many resources available to help navigate the world of agency buying & selling.

But it shouldn't be this way because deals are done all the time and agencies can be excellent, high-growth, high-profit businesses.

Digital agencies can be quite difficult to sell. Growth consultant Jason Swenk revealed on Jake Jorgovan's podcast that only 0.25% of agencies get sold.

Yes, it's difficult, but not impossible. Let's not forget there are nearly 10,000 marketing agencies in the United States alone so the absolute number of total agencies sold per year is higher than you might expect.

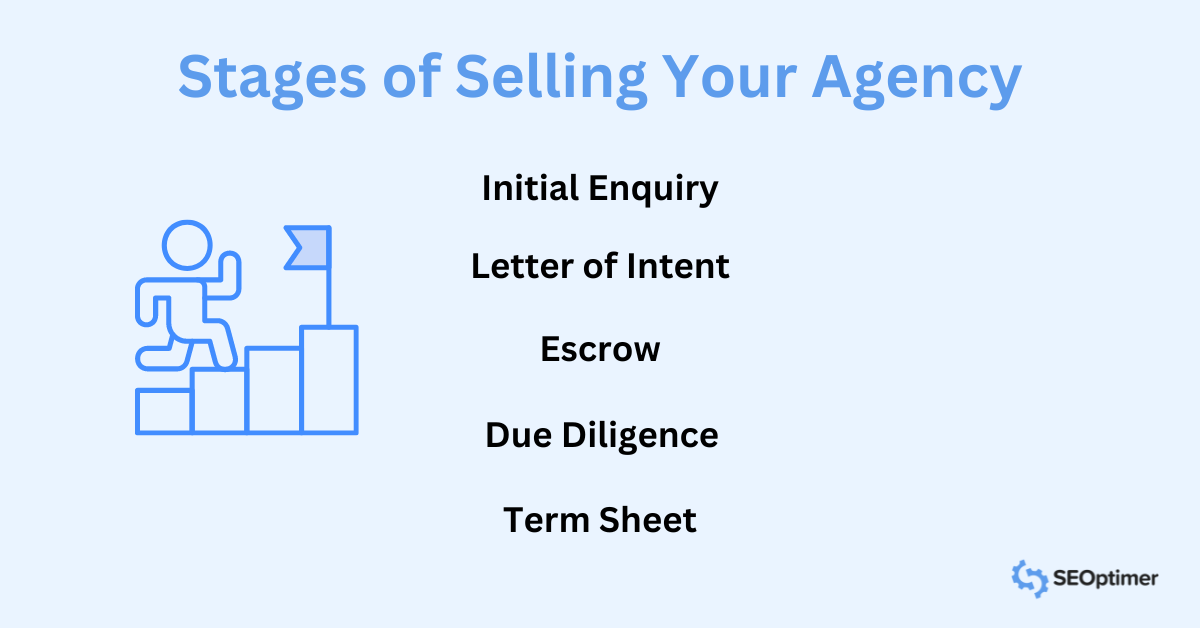

Stages of Selling

If you've ever asked yourself, "how do I sell my agency?", you might be a little lost as to where to start or even what the steps are.

For founders who successfully sell their agency, the entire process can take several weeks to several months as there are many factors that impact the process.

As a rough guide, Jason outlined the 5 typical stages you'll likely go through when selling your agency:

-

- Initial inquiry: these are the early stage back and forth emails and calls between you and prospective buyers

- Letter of Intent (LOI): an LOI is where things start to get serious. It outlines what the buyer is willing to pay and a high-level structure of the deal. You need to be comfortable with the general terms described in the LOI - otherwise it's time to negotiate

- Escrow: optionally asking the prospective buyer to put a small percentage of money in an escrow account can help weed out time-wasters. If the buyer backs out, you keep the escrow money. If the sale goes ahead, the money is subtracted from the sale amount

- Due Diligence (DD): Steve Jobs famously described this stage as "opening the kimono". Everything is shared between you and the buyer including detailed financials, pipeline, previous performance etc

- Term sheet: if DD goes well, the term sheet is the legal document that spells out every detail of the sale. It is very common to have a cash amount and an earn-out (eg: agency valued at $5 million with $1 million cash upfront and $4 million in equity over time)

Why are Agencies "Hard" to Sell?

Agencies are usually founded as creatively-led endeavors by founders emotionally invested in their business.

Although you can say this for many businesses outside of marketing, agencies usually hold no tangible IP (Intellectual Property) or physical assets making them unattractive to 'traditional' investors.

An agency's 'value' is in the sum of it's people, client roster, internal processes, industry reputation and cred - all subjectively valuable assets.

Furthermore, scaling agency growth can only be achieved by adding more people whereas some traditional businesses or software businesses can scale exponentially.

These aren't negative attributes, they just reduce the potential buyers in market to those who understand how service-based businesses work and how they can translate value in an agency to business value.

Why Sell Your Agency?

According to agency M&A advisors, Barney, there are three main reasons why agency founders sell their agency:

-

- Fatigue: close this chapter and pursue the next challenge: “this was fun at the start and now it’s not”

- Growth: highly profitable or quickly growing revenue: “this thing is flying and we need to strike while the iron's hot”

- Negative growth: loss of revenue, clients or key team members: “we no longer have a path to grow and would like to find some value for what we’ve built”

Hans Skillrud founded Chicago-based web design & development agency BuildThis in 2012.

The agency positioned itself as a bespoke service provider that can tailor web and app projects to clients' specific needs by operating small dedicated teams for each client. Hans successfully grew the agency to 12 people.

In 2019, Hans sold BuildThis to Iowa digital agency Webspec Design. Both Hans and Webspec's CEO & Founder Jeremiah Terhark generously shared their thoughts with me about the journey of selling (and buying) BuildThis.

Today Hans is the Vice President and Cofounder of Termageddon, a Privacy Policy generator for websites and apps.

Ultimately for Hans, he was juggling the daily operations of BuildThis while also launching Termageddon at the same time.

"There was not enough time in the day to run the agency while trying to launch a new startup."

Building a new business is a huge undertaking and doing so while running another business (or multiple businesses) is even harder.

Hans also said the agency was looking at a potential capital raise to expand so timing seemed optimal given how intensive a potential capital raising process can be.

For Jeremiah, an acquisition of a successful agency in the Chicago area was an ideal move. He founded Webspec Design in 2000 and had experience already in the agency acquisition process:

"Webspec has brought on three agency acquisitions so far and we primarily were looking to grow in company size, bring on additional talented team members, and add more value to clients."

How to Sell Your Agency

If you've decided to begin the journey of selling your agency, Hans recommends connecting with other agency founders who've been through the process already.

He luckily had some experience on the other side as a buyer of an agency a few years prior so he had an idea of how the deal could work as a seller.

Everyone's priorities and motivations will be different. This can become potentially complicated if multiple founders are involved in the business, especially if there isn't full alignment on the sale process and desired outcomes.

Thankfully for Hans, he was a solo founder which made it much more straight-forward.

"What mattered to me most was that my existing staff could retain their jobs with the transition and that I could walk away entirely so that I could focus on my new company. There were several potential buyers that made sizeable offers but did not meet these terms so I had no interest in selling to them."

Webspec's CEO, Jeremiah offered his perspective on this point too:

"We had some negotiation, but it's important that the structure of the deal works well for both the buyer and seller."

Calculating What Your Agency is Worth

So you might be thinking, how much do agencies sell for? Understanding why a potential acquirer wants to acquire an agency will help you understand how they value it.

Jason Swenk suggests there are three main reasons a buyer wants to acquire an agency:

-

- Rapid Expansion: if you have a solid reputation for a specific service or skill set, a buyer might be interested in acquiring your agency. The thing is, your processes and systems also have to be totally solid. An acquirer who wants to grow rapidly is only interested in an agency that is running efficiently. They aren’t interested in growing organically (or they’d just do it themselves).

- Geographic Expansion: sometimes a great agency is looking to expand in your area. Rather than starting at square one and opening a satellite office in a new location, a buyer will look to acquire an agency that’s already established in their desired location. If you want to attract a buyer like this, just be the best and get known for it!

- Market Share Expansion: some buyers might be motivated to purchase based on your client list. They simply want a bigger piece of the pie and they’re willing to pay for it. If you’re equally motivated to exit then there could be a match.

A lot of early conversations with prospective buyers will center around growth and profit margin. A good range of growth is between 15% and 50% gross looking historically at the previous 3 years.

If things are trending in a positive direction you'll be in a strong position to negotiate on valuation. Of course, growth is great but profit margin needs to be healthy too. Jason suggests a profit margin of 40%+ is where you want to be in an ideal scenario.

Resources like Business Value Academy offer education for founders to help them calculate the value of their agency. It's Co-Founder Cory Miller, sold his agency iThemes in 2018 and wrote recently about the 5 key measures of business value:

-

- Job profitability

- Revenue per billable performer

- Revenue per employee

- Lead value

- Customer satisfaction

Greg White from business brokerage firm Viking Mergers & Acquisitions says that a very rough guide to valuing a marketing agency is to multiply EBITDA or Cash flow to arrive at a rough ballpark valuation:

- 4-6x EBITDA

- 3-4x Cash flow

Agency founder Jeff McGeary suggests the value of a digital marketing agency is based on the results they provide:

Analyzing previous campaigns, websites or other digital assets can help an outsider understand the potential reach and engagement around activities.

Ultimately if an agency can correlate marketing activity to an increase in sales/conversions for the client, this is the best outcome.

Finding Potential Buyers

If you're in the enviable position of having buyers knocking on your door pro-actively seeking a sale, you already have the upper hand. However, most founders will likely need to hunt for potential buyers.

When selling BuildThis, Hans listed his agency on BizBuySell - a marketplace that connects business buyers and sellers. Another popular marketplace for listing agencies for sale is BusinessesForSale.

Within 24 hours of listing, Hans received inquiries from several dozen legitimate buyers.

"It’s also a great way to get insight into how to value your business by looking at similar companies for sale".

For Hans, aside from ensuring his staff would be fully retained, he was looking for buyers who were team-oriented (and not just solely interested in the client list).

He was also looking for buyers who were established businesses themselves (like a competitor) and he wanted to find a buyer he could trust (as he knew a portion of the sale would be based on future earn-out).

From these criteria, Hans shortlisted 2 potential 'best-fit buyers'.

"It was very important to me that staff were open and willing to accept a transition with a specific team, so I had managers and early employees join in on conversations with the two shortlisted buyers."

Negotiating the Deal

The Due Diligence (DD) process for Hans was extensive with activities falling into three main groups:

- Reviewing financials: full access to the agency's Quickbooks account to verify all numbers and results

- Meetings with managers: to verify leadership skills and how they would take the company to the next level

- Group and individual meetings with staff: to understand capabilities and depth of experience across the team

The buyer (Webspec Design) also reviewed current and previous client work and any outstanding legal issues. The full process took between 60-90 days to complete with one round of back and forth on valuation.

But given the initial range was considered 'right' by both parties, it made negotiations easier.

Although Hans did not do this, he recommended founders should push to be paid 1-2x of the recurring revenue from maintenance clients. He instead opted for raising the commission percentage on future revenues (earn-out).

Doing the Deal

Art Stevens is the Managing Partner of The Stevens Group who consults with agencies specifically regarding M&As (mergers and acquisitions).

After handling countless agency M&As he believes communication is the key ingredient to ensure both buyer and seller are satisfied AND that the staff and clients across both agencies have a positive experience throughout the process:

"Unfortunately, in cases where communications were handled poorly during an acquisition, management ends up with dissatisfied employees, skeptical clients, and a baffling brand message, among other issues. These effects can create long-term — sometimes permanent — damage."

Art suggests continuously keeping communication lines open as early as possible and keep updating employees, letting them know their place and how they can help make the acquisition process more seamless.

If both the buyer and seller are fully committed to transparency and constant communication to all stakeholders from the start, the integration period can be a genuine growth opportunity.

When Hans had the term sheet signed he brought all his staff together to discuss the future of BuildThis:

"Rather than focusing on the past in this meeting, I focused on the promising future staff would have under new ownership. Transitions are scary for people, so I tried my best to show how exactly this transition will work, which I think helped reduce any stress."

Other Factors That Influence the Value of Your Agency

Agency Earnings

One of the first things potential buyers look at is your agency's earnings. This includes revenue, profit margins, and growth trends.

It's essential to have clean, transparent financial statements that demonstrate consistent profitability.

Buyers will scrutinize your earnings to assess the viability and sustainability of the business. Make sure you have a clear picture of your financial health before entering any negotiations.

Agency Client List

Your client list is another critical asset. High-profile clients or long-term contracts add considerable value to your agency.

Prospective buyers will assess the diversity and stability of your client base, as well as the nature of your relationships with them.

Agency Employees

The strength of your team can make or break a deal. Skilled, experienced, and loyal employees add immense value to your agency. Buyers are often interested in the talent they will inherit as much as the client list.

Overall Management of the Agency

Effective management is crucial for the smooth operation of any agency. Buyers will evaluate your management systems, processes, and leadership team to ensure they can seamlessly take over the reins.

Agency Failure Points

Every business has its weaknesses, and identifying them is crucial for a transparent and honest evaluation. Understanding and addressing these points can make your agency more attractive to buyers.

Business Specialization

Specialization can significantly impact your agency's valuation. Niche agencies often command higher premiums due to their specialized knowledge and expertise.

Frequently Asked Questions

How Much Can You Sell an Agency for?

The selling price of an agency varies widely based on factors such as earnings, client lists, team strength, and market conditions.

Typically, agencies are valued at a multiple of their EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

This multiple can range from 2x to 10x or more, depending on the agency's growth prospects and market position.

How Do I Value My Agency?

Valuing your agency involves a combination of quantitative and qualitative assessments. Key metrics include revenue, profit margins, client contracts, and employee expertise.

Factors such as market positioning, growth potential, and industry trends play a crucial role in determining your agency's value.

Using the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measurement is also one of the easiest and most accurate ways to determine the value your business.

Final Thoughts

Jason Swenk recommends to "build a business to sell but treat it like you never will". This is great advice.

Putting effort into tracking your monthly, quarterly and yearly growth & profit margin will put you in good stead once you're ready to begin the hunt for buyers. Our previous agency resources will help you grow your lead pipeline, convert and expand business too. Be sure to check out: